Tesla Shanghai Gigafactory BREAKTHROUGH. 95% Robotic, 4X Faster Production of Model YL

by Brian Wang

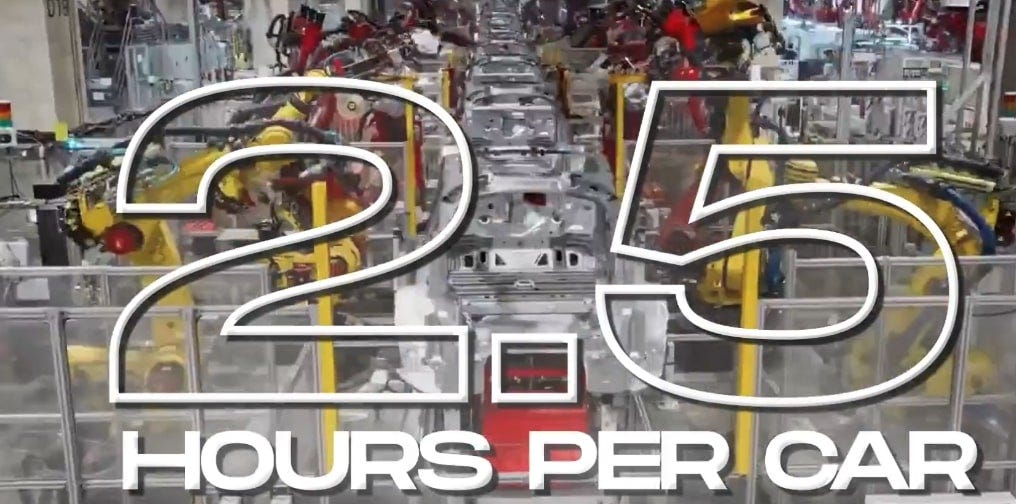

Tesla Giga Shanghai’s only needs ~2.5 hours to build a Model YL end-to-end. This is a 75% reduction from Tesla’s pre-2023 internal KPIs of 8-10 hours, achieved via unboxed parallel assembly (where subassemblies like chassis, battery, and interior converge simultaneously rather than sequentially). For context, VW’s legacy plants clock in at 20-30 hours per vehicle, with even their fastest EV line (ID.3 at Zwickau) at 16 hours. The gap isn’t just speed; it’s waste elimination—Tesla’s flow eliminates ~80% of touch labor and transport loops that plague stamped-welded lines.

95% built by robots, reducing assembly time to 2.5 hours per car (vs. 10 hours previously for Tesla and 30+ hours for competitors like Volkswagen).

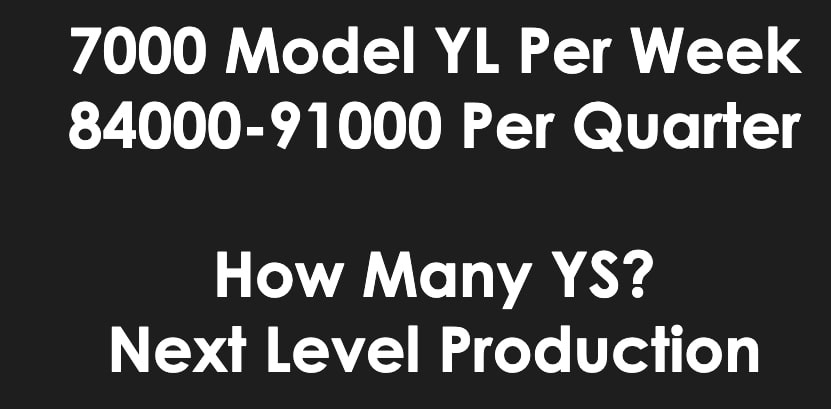

Output: 1,000 Model Ys per day (potentially 7,000/week, 30,000/month, or 365,000/year if nonstop).

Features mega-castings and high automation, enabling 3-4x efficiency gains.

This could scale to 84,000-91,000 units/quarter, easing Q4 delivery concerns. No export listings yet for these vehicles.

Implications for Low-Priced Vehicle and Broader Production

Tying into tomorrow’s (October 7, 2025) anticipated announcement of a ~$35K vehicle (headlights and tires match leaked images): Same processes could apply to Model 3/Y variants, potentially hitting 50,000+ vehicles/month in Shanghai (1.8M/year).

Global rollout to Austin, Berlin, and Fremont could boost production by 50% or even double output from existing footprints, freeing space for Cybercab production.

Cost benefits: Lower labor (only 5% manual), higher throughput spreads fixed costs, enabling $25K pricing in China and sub-$30K in the US.

Long-term: 100% robotic factories could spread to other industries, boosting GDP 5-10x via automation.

Stock and Market Sentiment TSLA recovered to $454 post-Q3 sell the news dip, up on low volume (55M shares), signaling few sellers amid positive catalysts (FSD v14 release today, low-cost vehicle reveal).