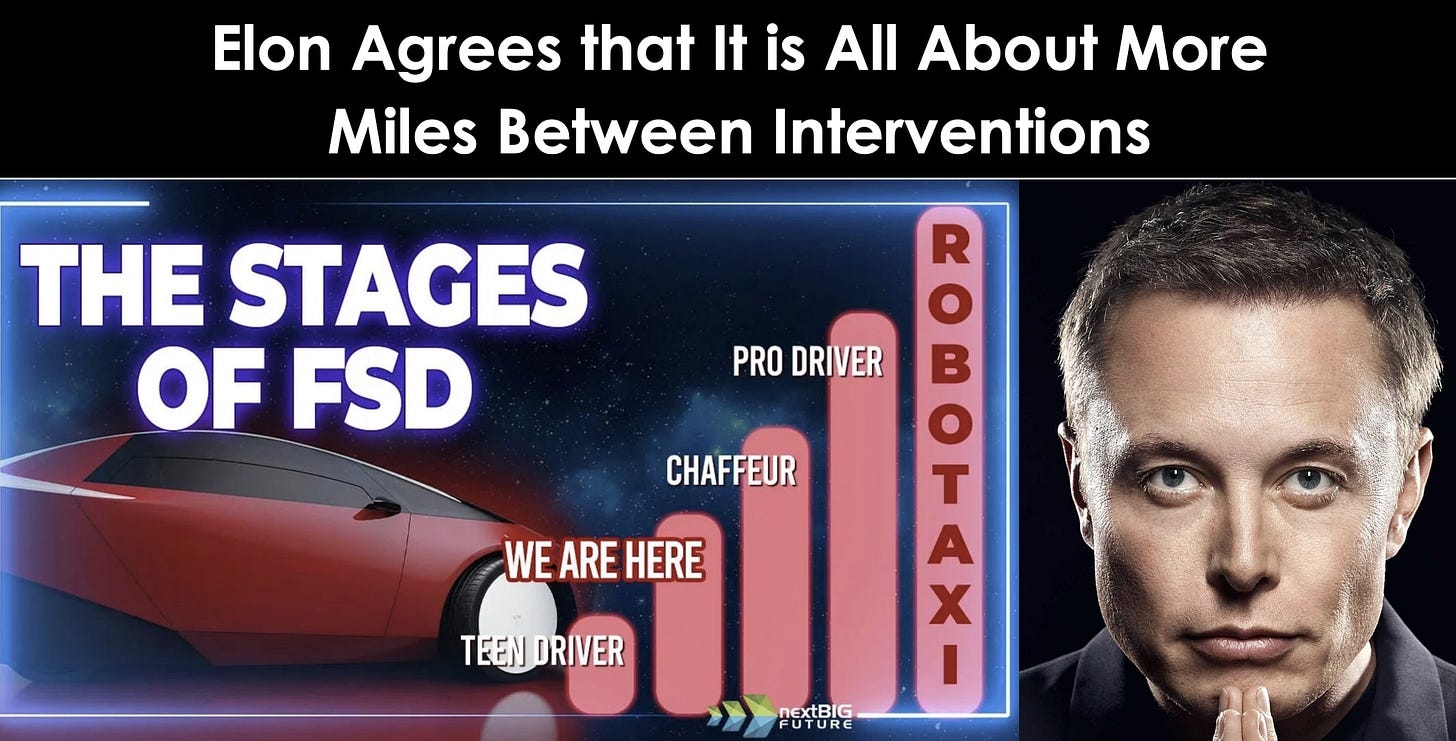

Elon and Nextbigfuture Agree that All that Matters is More Self Driving Miles Between Interventions

By Brian Wang

Elon has said that :

All that matters is improving Tesla self-driving AI such that miles between interventions is >> human

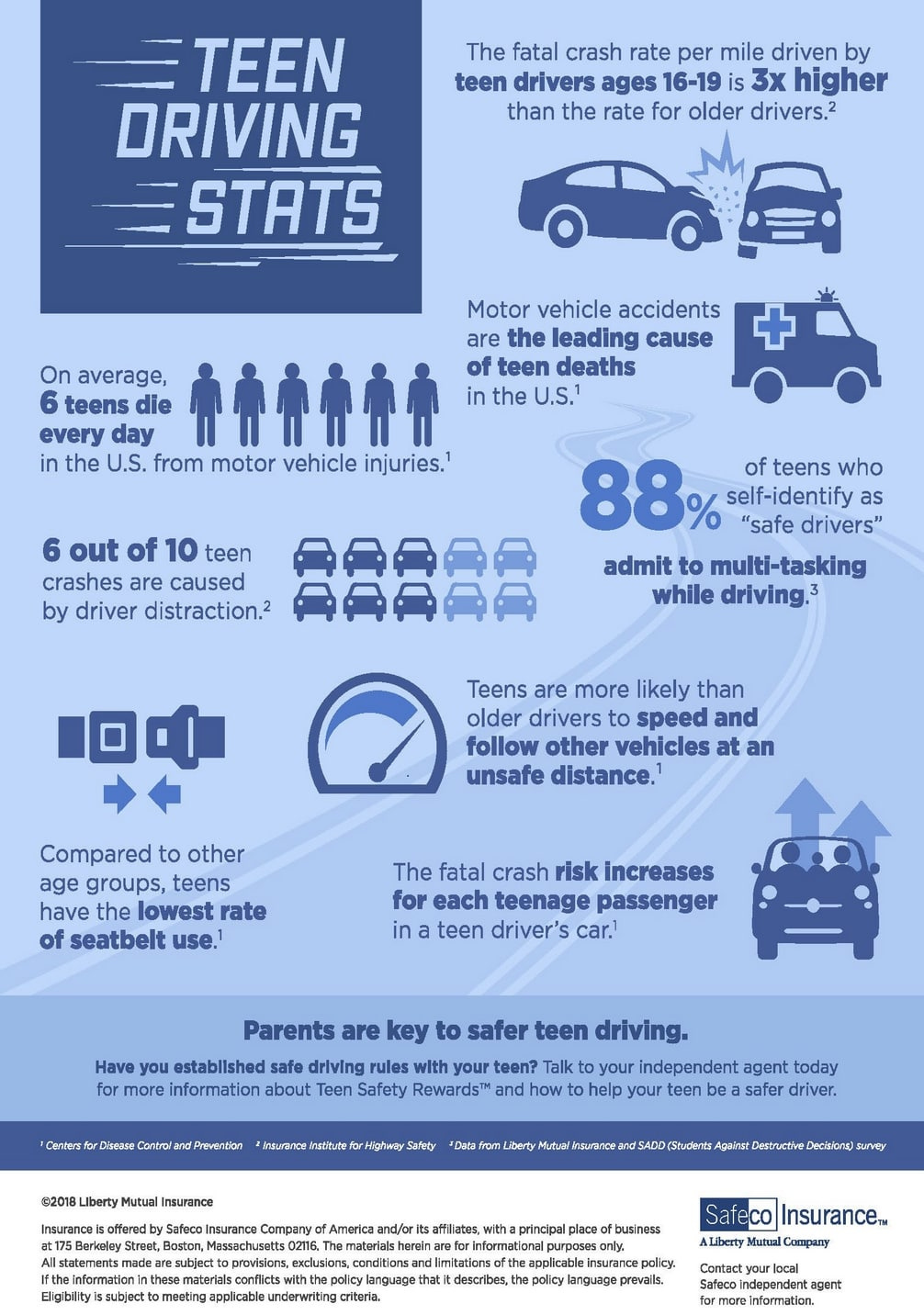

This statement supports my analysis and video that Tesla FSD reaching each major new level on miles between interventions makes each radically improved FSD an entirely different product. Every 3-10X leap in miles between interventions is like leaping from a bad student driver to an average driver or an average driver to a good professional driver.

Elon and Nextbigfuture agree that all that matters is more self driving miles between interventions. FSD 12.4.3 is showing more intervention free drives and thus more miles between interventions. Freda Duan of Altimeter Capital has just tested all of the main robotaxi and self driving systems in the US and China. She confirms that Tesla is leading the way to a complete self driving solution and that China lidar systems are ahead of US competition other than Tesla. China robotaxi operators and car companies will adopt Tesla FSD if the miles per intervention leap ahead as Elon has said will happen with 12.4.X and 12.5. China will then push ahead with rapid mass approvals and mass adoption. Tesla and China robotaxi companies will jointly reach million robotaxi scale in 2035-2026 in over 600 chinese cities.

Tripling miles between interventions is like improving from a teenage newly licensed driver to an experienced driver.

Whole Mars says Tesla FSD 12.4.3 drives like a professional chauffeur. It executes many maneuvers more smoothly than a human could, and can often react to road hazards before the human driver even notices them

First Hand Experience Report- Tesla FSD is better than China L2 Self Driving Competition

Highlight and Nextbigfuture inferred conclusion: China companies using Lidar and hypermapping can get good experience and safety on main roads and major cities but have issues outside of those situations. Tesla FSD getting to a full solution will greatly speed the expansion of robotaxi in China and the world.

Freda Duan of Altimeter capital reports on all of the robotaxi and self driving systems. She just finished a one-week trip to China. She summarizes all the major (~20) L2 self-driving and robotaxi vehicles in both the US and China.

▶️L2 self-driving

I [Freda] tested major brands like $Huawei, $Li, $NIO, $Xpeng, and $Xiaomi. Overall, they exceeded my expectations. The rides were not overly cautious and handled complex situations (yes, road conditions in China are very challenging!) quite well.

Nothing compares to $Tsla's approach. I see imitation learning/end-to-end as the only effective approach for self-driving. While Chinese peers perform well on main roads, they struggle on frontage roads due to reliance on high-precision maps and rule-based methods (e.g. cars stopped in the middle of the road where there was no clear white lining).

Chinese EVs' self-driving capabilities are far ahead of those from US and EU brands.

I doubt any Chinese players can profit from L2 self-driving, not because it’s not useful, but because it’s hard to differentiate, and price wars dominate the market in China.

Chinese consumers and regulators seem much more receptive to self-driving. Even with a 5/10 self-driving capability, cars are practically *hands-free(!)*

Insurance-wise, for L3+ cars, OEMs bear responsibility for incidents, so OEMs avoid labeling cars as L3+.

▶️Robotaxi

I [Freda] tested major brands like http://Pony.ai, $Didi, and $Bidu. I'd rate http://Pony.ai equal to $Waymo, and it's ahead of other peers.

However, the same issue applies here: user experience is nearly perfect (in Yizhuang, Beijing), but expansion is the real question.

Chinese robotaxi companies are very sophisticated. While the rest of the world focuses on technology, Chinese peers treat it as a product, considering unit economics, operations, mass production, etc.

Interestingly, most companies expressed a preference NOT to operate fleets themselves. They aim to be asset-light and let fleet managers handle operations.

Policy Support: China has a very clear approval process, driven by data (autonomous driving distance, fully driverless distance, intervention rate, passenger ratings, etc.).

▶️Chinese EVs

In major cities like Beijing or Shanghai, EV adoption (green license plates vs. gas cars with blue license plates) seems to be 40%+. If 40% of cars on the road are EVs, then EV penetration (defined as the % of new car sales) must already be over 50%.

In shopping malls, the ground floor is filled with EV showrooms—easily 10+ brands, many of which are unfamiliar Chinese brands. It appears almost too easy to make an electric car, which is a stark contrast to the US. $Xiaomi, for example, can achieve a 10% gross profit margin in its first year of operation, compared to $RIVN's -45%. Additionally, $Xiaomi cars are priced at 30% of $RIVN's price.

It's fascinating to see how China transitioned from "couldn't make their own gas cars at all (only JVs)" to "dominating EVs globally." The government deserves credit for setting the direction and executing effectively. China now controls the entire supply chain, with $CATL holding 40% of the global market share.

Keep reading with a 7-day free trial

Subscribe to next BIG future to keep reading this post and get 7 days of free access to the full post archives.