AI spending is huge and it is sustainable and has indications that it is profitable spending. This has huge implications for the share prices of Nvidia, Microsoft, Apple, Amazon, Meta, Google, Tesla , XAI, Broadcom and TSMC. It is also has implications for imminent superintelligence and civilization getting reshaped over the next few years and beyond.

Returns are from AI are being seen. The smaller spending from 2 years ago sees a lag in returns but adjusting for lag shows profits.

Pascal’s Wager Applied (CEOs Believe in Godlike AI)

Invest and AI Succeeds: Huge payoff—competitive advantage, innovation leadership, and returns on investment (e.g., breakthroughs in compute-intensive tasks like drug discovery or climate modeling). The cost of building data centers is dwarfed by the benefits.

Invest and AI Fails: Loss of capital—money spent on infrastructure, energy, and maintenance yields little return. The cost is significant but finite.

Don’t Invest and AI Succeeds: Missed opportunity—competitors or other nations dominate, and you’re left behind in a potentially world-altering technological shift. The regret and strategic disadvantage could be catastrophic.

Don’t Invest and AI Fails: Minimal loss—you save resources and avoid a sunk cost, but there’s no gain either.

The BG2 podcast (with semiconductor , AI analyst Dylan Patel) describe the AI investment.

This was an AI scaling and spending discussed by multi-billion fund managers Bill Gurley and Brad Gerster with top AI analyst Dylan Patel.

Free cashflows from Meta, Microsoft, Amazon, Google and other are going into AI data centers and AI research.

There is a discussion of capex spending of hyperscalers ( the capex investment part of the discussion of BG2).

Gurley’s broader narrative aligns with analyses from sources like Morgan Stanley and Dell’Oro Group, which project hyperscaler CapEx reaching $300–$335 billion in 2025, largely driven by AI. For instance, Morgan Stanley’s updated forecasts (reported February 20, 2025, via Datacenter Dynamics) estimate Amazon and Microsoft leading with $96.4 billion and $89.9 billion, respectively, in 2025 CapEx, with AI infrastructure as a primary driver. Gurley’s discussions in prior years suggest he views this as a strategic necessity.

$320 billion in spending from the top four companies in 2025 CapEx projections:

- Amazon - $100 billion, up from $83 billion in 2024

- Microsoft - $80-90 billion, up from $55 billion

- Google - $75 billion, up from $52.5 billion

- Meta - $65 billion, an increase from $39 billion

XAI is raising $10 billion at $75 billion valuation. XAI will successfully raise and then will raise again. My estimate $30-40 billion at $200-300 billion valuation later in 2025.

XAI will build and is building for Grok 4. In the first two months of 2025 XAI already has 2.5X the Grok 3 100K H100s compute cluster. Chips and energy already installed for the 200K chips. The natural gas turbines to double power is already bought and is installing. This 2025 build is committed and will happen, fundraising is certain. My projection of the 400K GPU expansion is purchased is installing (power and chips) 3 months.

The 1M GPU will be installed (another 600K chips) and 1.2 GW (another 700 MW) will get money and built by the end of 2025. Bets are being made without waiting to see results or returns from prior bets. Pascals AI wager.

Big Tech CEOs See Value

For the October–December 2024 quarter, Microsoft reported a 10% increase in profit and a 12% revenue increase to $69.6 billion, with earnings before interest and taxes (EBIT) up 17%. CEO Satya Nadella noted that the AI business surpassed a $13 billion annual revenue run rate, up 175% year-over-year, suggesting significant topline growth driven by AI. [AI Is paying now and paying off more, but the landgrab and competition forces putting all winnings and more ahead of the growing payoff rate]

Cash Flow Resilience: Even with the CapEx surge, Microsoft generated $74.07 billion in free cash flow in fiscal 2024, up 24.5%, indicating that its financial health remains robust despite the spending.

Google’s AI investments are showing early returns, with over 25% of new code generated by AI internally, boosting operational efficiency. Cloud growth is partly attributed to “accelerated growth” in AI products, indicating some monetization success.

Meta integrates AI into its platforms. The rapid uptake of AI tools by advertisers (4 million users, up from 1 million in six months) shows real-time returns, particularly in ad targeting. Analysts like JPMorgan’s Doug Anmuth note that “the return on AI investments is more apparent in Meta’s core advertising business” than in Google’s cloud.

Value of AI investment, the $20 billion investment 2 years ago results in $10 billion per year on average for the next 3 years. They are getting positive return BUT they are reloading with $80-90 billion now which could pay off with $30-50 billion per year for 3 years. But they will go with more investment at $150 billion per year in 2027-2028.

Deepseek is claiming 85% margins. $200 million per year.

Hyperscaler and other AI companies can and will also tap into the sovereign wealth funds.

The dot.com era Internet and Cisco and network spend had a delay in the payoff after the temporary overbuild. But those ended up paying off.

2024 FCF: The Magnificent 7 collectively generated an estimated $350–400 billion in free cash flow in 2024, with approximate individual contributions as follows (based on the most recent data):

Apple: ~$108.8 billion

Microsoft: ~$74.1 billion

Alphabet: ~$72.8 billion

Meta: ~$54.1 billion

Amazon: ~$50.1 billion

NVIDIA: ~$39.2 billion

Tesla: ~$3.5 billion (quarterly annualized is $8-9 billion)

All the free cashflow is after R&D and capex.

2026 is when the current bets and spending must payoff. My calculations and Dylan is that the models will get better and payoff. But my prediction is that XAI and Tesla could get better AI and better returns. So the fact that the total investments should pay, returns will not be equal.

Dylan at 1 hour 24 says they (Big Tech) will take free cashflow to zero by increasing AI spending.

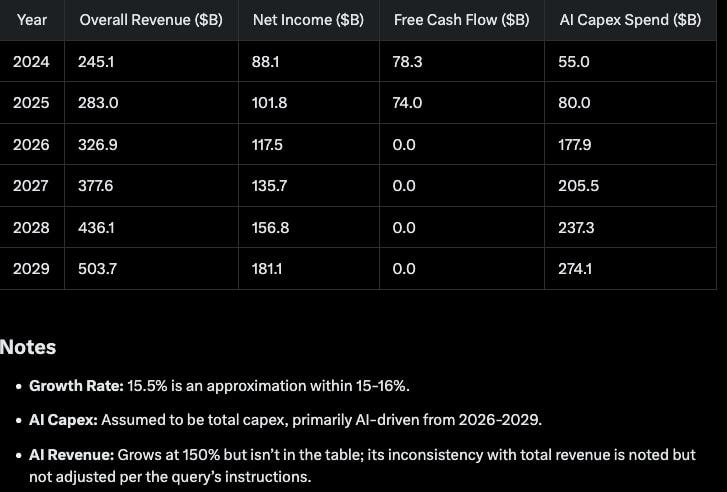

If this happened for Microsoft, then it would mean increasing AI and research to about $250-300 billion from Microsoft alone. The 15% per year growth in revenue and net income could support the growing investment shown below.

The other BIG tech companies have similar growth rates and combined they will be able to head to over $1 trillion per year in AI spend / data center capex spend. This would be a sustainable use of free cashflow generated by growing businesses.

Keep reading with a 7-day free trial

Subscribe to next BIG future to keep reading this post and get 7 days of free access to the full post archives.